Ct Credit For Property Taxes Paid 2020 . download and print the official form for filing your 2022 connecticut income tax return. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal. the connecticut property tax credit can be entered on your connecticut return by following the steps below: connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors,. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. Learn how to calculate your tax, enter your.

from www.uslegalforms.com

Learn how to calculate your tax, enter your. download and print the official form for filing your 2022 connecticut income tax return. learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors,. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. the connecticut property tax credit can be entered on your connecticut return by following the steps below: beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal.

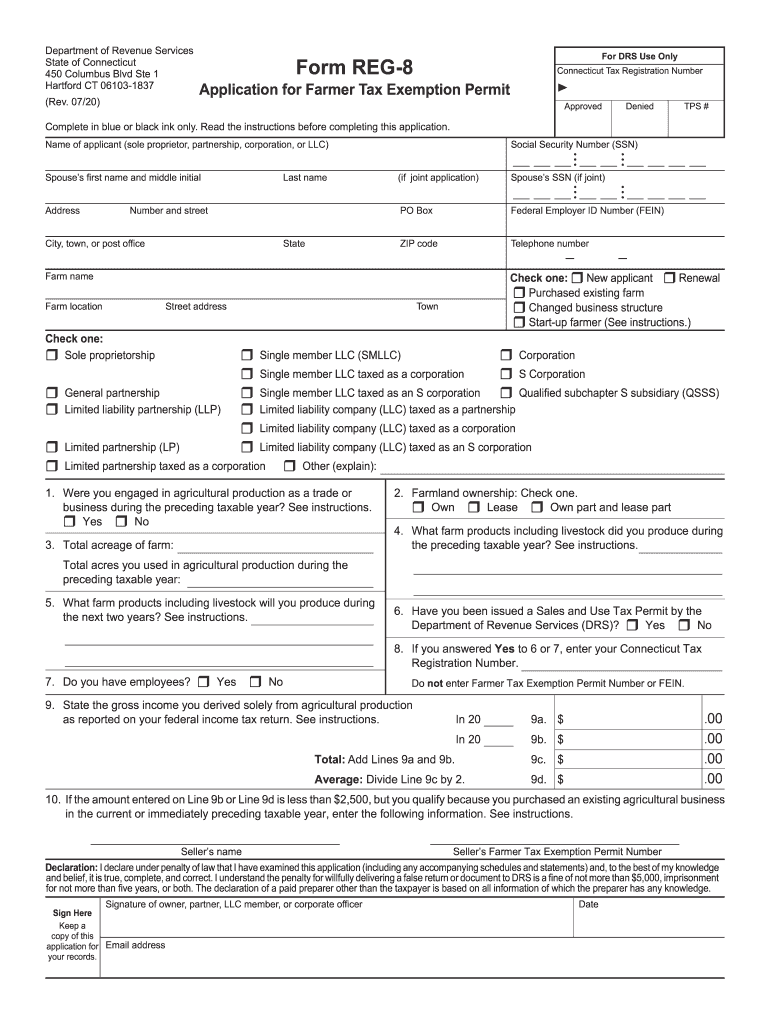

CT REG8 2020 Fill out Tax Template Online US Legal Forms

Ct Credit For Property Taxes Paid 2020 enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. download and print the official form for filing your 2022 connecticut income tax return. beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors,. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. Learn how to calculate your tax, enter your. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. the connecticut property tax credit can be entered on your connecticut return by following the steps below:

From princewilliamliving.com

Deadline Extended to Pay Real Estate Taxes for Second Half of 2020 Ct Credit For Property Taxes Paid 2020 the connecticut property tax credit can be entered on your connecticut return by following the steps below: download and print the official form for filing your 2022 connecticut income tax return. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. beginning with. Ct Credit For Property Taxes Paid 2020.

From www.uslegalforms.com

CT REG8 2020 Fill out Tax Template Online US Legal Forms Ct Credit For Property Taxes Paid 2020 by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. connecticut laws require municipalities to provide property tax relief for specific. Ct Credit For Property Taxes Paid 2020.

From www.amybergquist.com

Calculating West Hartford Property Taxes for July 2022 to June 2023 Ct Credit For Property Taxes Paid 2020 beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal. the connecticut property tax credit can be entered on your connecticut return by following the steps below: by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120HH Download Printable PDF or Fill Online Historic Homes Ct Credit For Property Taxes Paid 2020 Learn how to calculate your tax, enter your. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. the connecticut property tax credit can be entered on your connecticut return by following the steps below: learn how to file your connecticut resident income tax. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120GB Download Printable PDF or Fill Online Green Buildings Ct Credit For Property Taxes Paid 2020 the connecticut property tax credit can be entered on your connecticut return by following the steps below: connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors,. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120RC Download Printable PDF or Fill Online Research and Ct Credit For Property Taxes Paid 2020 beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. download and print the official form for filing your 2022 connecticut income tax. Ct Credit For Property Taxes Paid 2020.

From corinebjoella.pages.dev

Ct Property Tax On Electric Vehicles Daune Justina Ct Credit For Property Taxes Paid 2020 enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal. the connecticut property tax credit can be entered on your connecticut return by. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Schedule CTPE Download Printable PDF or Fill Online PassThrough Ct Credit For Property Taxes Paid 2020 learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. the connecticut property tax credit can be entered on your connecticut return by following the steps below: enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120SF Download Printable PDF or Fill Online Service Facility Ct Credit For Property Taxes Paid 2020 learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. download and print the official form for filing your 2022 connecticut income tax return. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes.. Ct Credit For Property Taxes Paid 2020.

From www.signnow.com

Connecticut Tax Form Fill Out and Sign Printable PDF Template Ct Credit For Property Taxes Paid 2020 the connecticut property tax credit can be entered on your connecticut return by following the steps below: learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the. Ct Credit For Property Taxes Paid 2020.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Ct Credit For Property Taxes Paid 2020 learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. download and print the official form for filing your 2022 connecticut income tax return.. Ct Credit For Property Taxes Paid 2020.

From www.signnow.com

Ct Tax Form 0s 114 Fill Out and Sign Printable PDF Template Ct Credit For Property Taxes Paid 2020 by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors,. learn how to file your connecticut resident income tax return electronically or by mail,. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120K 2020 Fill Out, Sign Online and Download Printable PDF Ct Credit For Property Taxes Paid 2020 connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors,. download and print the official form for filing your 2022 connecticut income tax return. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes.. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120DA Download Printable PDF or Fill Online Digital Animation Ct Credit For Property Taxes Paid 2020 connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors,. enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately owned or leased. Learn how to calculate your tax, enter your. download and print the official form. Ct Credit For Property Taxes Paid 2020.

From www.signnow.com

Ct Nys 20202024 Form Fill Out and Sign Printable PDF Template Ct Credit For Property Taxes Paid 2020 beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. connecticut laws require municipalities to provide property tax relief for specific groups of. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120SF Download Printable PDF or Fill Online Service Facility Ct Credit For Property Taxes Paid 2020 beginning with the 2022 tax year, this bill increases, from $200 to $500, the maximum property tax credit against the personal. by law, taxpayers earn the credit for property taxes paid on their primary residences or motor vehicles, and the amount of property taxes. connecticut laws require municipalities to provide property tax relief for specific groups of. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120 FCIC Download Printable PDF or Fill Online Fixed Capital Ct Credit For Property Taxes Paid 2020 learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. download and print the official form for filing your 2022 connecticut income tax return. Learn how to calculate your tax, enter your. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such. Ct Credit For Property Taxes Paid 2020.

From www.templateroller.com

Form CT1120 EDPC Download Printable PDF or Fill Online Electronic Data Ct Credit For Property Taxes Paid 2020 learn how to file your connecticut resident income tax return electronically or by mail, and get information about tax credits,. the connecticut property tax credit can be entered on your connecticut return by following the steps below: enter below the property tax paid in 2020 to a connecticut city or town on your primary residence or privately. Ct Credit For Property Taxes Paid 2020.